In just a few years, Australia’s insurance market has gone from one of the hardest in recent memory to one of the softest. Premiums are falling. Quotes are suddenly easy to come by. And a number of insurers who once pulled back from engineering risks are re-entering the market, looking to secure business they had not long ago declined to cover.

For engineers with professional indemnity insurance, this sudden shift may seem like a welcome relief – especially after years of rising premiums, tighter underwriting and fewer options. But behind the lower prices, important questions remain:

- Is a cheaper quote really offering the same level of protection?

- And what are you risking by switching insurers based on price alone?

Let’s take a closer look.

Understanding the insurance cycle

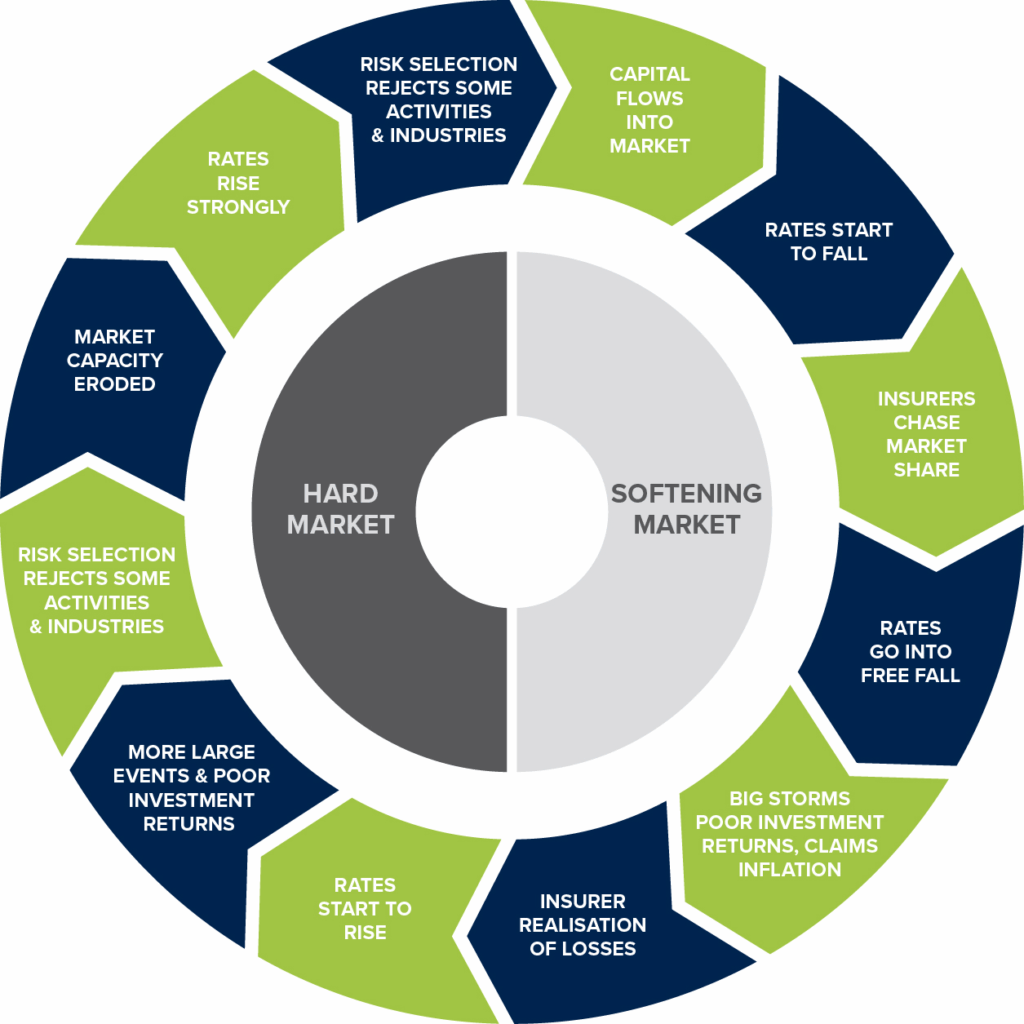

Insurance markets naturally move through cycles – from hard to soft and back again.

A hard market is characterised by rising premiums, limited insurer appetite and stricter underwriting. This often follows a period of heavy claims, economic pressure or global uncertainty. Many engineers will remember the difficulty of securing cover just a few years ago when certain Insurance carriers declined to renew policies or imposed sharp increases.

In contrast, a soft market brings increased capacity, competitive pricing and broader coverage options. New insurers enter the market. Appetite expands. Premiums fall.

That’s where we are now. But this swing isn’t without its risks.

“The shift to a soft market has been dramatic – while lower premiums may seem attractive, our concern is that engineers could be drawn into policies that aren’t fit for purpose. Price is important, but coverage is critical. That’s where expert advice makes all the difference.”

Maria Vidic, Broking Operations Manager, EngInsure

Why cheap premiums may come at a cost

When premiums fall too fast and insurers fight for market share, it can lead to “underpricing” – policies that look good on paper but carry hidden gaps in coverage. We’ve seen quotes from new players offering half the premium and beyond – but with exclusionary language, sub-limits or clauses that could leave engineers exposed.

Also consider online distribution platforms which make it easy to “self-serve” insurance without the guidance of a specialist. If your quote was generated without careful review of your contracts and your client activities, are you confident the cover is actually fit for purpose?

At EngInsure, we regularly review competitor policies and find critical differences. Sometimes the reduced price tag comes with a price.

CASE IN POINT

One EngInsure client was declined by an endorsed industry provider due to project risk. Our team assessed the complexities and sourced the right cover when no one else could. That’s the difference an engineering-focused broker makes.

The big question: What happens when the market shifts again?

Many of the insurers now offering cut-price policies are the same providers who exited or restricted cover during the last hard market. Will they remain committed to the engineering sector if conditions tighten again?

At EngInsure, we supported engineers throughout the last hard market. We worked harder to secure cover when others said no. We’re proud to have been a consistent partner and to work with consistent insurer partners.

Why engineers choose EngInsure

You are the specialist in engineering. We’re the experts in insurance.

EngInsure works exclusively with the engineering sector, giving us a deep understanding of the risks, contractual demands and operational challenges you face. We offer:

- Access to local and global insurers with expertise in engineering risk

- Specialist policy advice including wording reviews and coverage comparisons

- Contract reviews to help you identify insurance-related clauses that could affect your protection

- A dedicated claims team to support you when it matters most

- A long-standing commitment to finding solutions – even in difficult markets

We are your insurance partner to assist in navigating the complexities of Professional Indemnity Insurance solely to the engineering profession, now and into the future.

Before you switch, ask…

- Why is this premium cheaper – and what’s missing?

- Is your policy tailored to your projects and clients?

- Who’s standing beside you at claims time?

- Has your policy been stress tested?

Talk to an EngInsure adviser

Whether you’re reviewing your current policy or just want to know your options, we’re here to help. EngInsure can help you ask the right questions – and make sure your cover matches your business.

To learn more about how EngInsure can support you in this changing environment, get in touch with our team today.

The contained information is general advice only. It is not intended to take the place of professional advice. Before acting on this information you should consider the appropriateness of this advice to your particular objectives, needs and financial objectives. Contact Whitbread Associates Pty Ltd | ABN 69 005 490 228 | License Number 229092 trading as EngInsure Insurance & Risk Services for further information or refer to our website.